Harley-Davidson Secures Domain Wins Amid Shifting Motorcycle Market

Jan/24/2025

Jan/24/2025

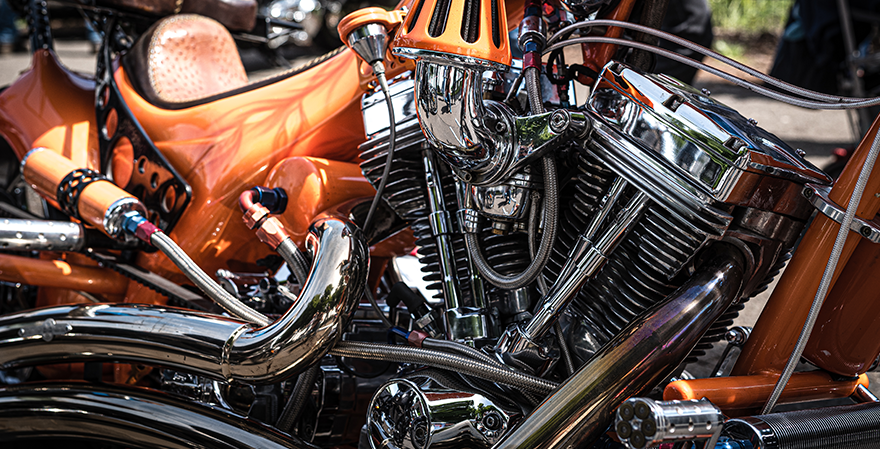

Harley-Davidson has successfully resolved two WIPO disputes involving the domains <harleydavidsonbuy.top> and <hdsale.top>, both ruled as infringing on the company’s trademarks. The latter was tied to counterfeit product sales, while the former, though inactive, was deemed confusingly similar to Harley-Davidson’s branding. These rulings highlight Harley-Davidson’s proactive defense of its intellectual property as it navigates an increasingly competitive market. In 2023, U.S. motorcycle manufacturing gross output reached $8.4 billion, with consumers purchasing approximately 547,000 motorcycles—up 1.9% from 2022. On-road motorcycles, particularly cruisers, dominated sales, accounting for 86% of the market’s $5.6 billion revenue. California led with the highest number of registered motorcycles and the highest average annual insurance premiums. Despite its dominance in the cruiser category, Harley-Davidson lost its top U.S. market position to Honda in 2023, with retail sales falling by 1% to $4.9 billion. Competing with global giants like Honda and Yamaha, Harley-Davidson faces evolving industry dynamics as the motorcycle market is forecast to experience significant revenue growth across all segments by 2029. The following chart illustrates this trend, with the On-road Motorcycles segment projected to lead the market, reaching a peak value of $6.67 billion. This underscores the positive outlook for the industry while highlighting the challenges Harley-Davidson must overcome to maintain its competitive edge.