Nvidia's Market Triumph Amidst U.S. Semiconductor Industry's Strategic Shifts

Mar/04/2024

Mar/04/2024

This landmark achievement was spurred by a 4% increase in Nvidia's share price to $822.79 on a recent Friday, underscoring the company's dominant position in the artificial intelligence computing sector. Nvidia's stock has surged by over 60% since the year's onset, driven by the explosive demand for its AI-centric chips. Although Alphabet, Google's parent company, has briefly surpassed the $2 trillion mark, it remains an outlier with Microsoft's valuation now over $3 trillion and Apple's having fluctuated below this threshold after previously crossing it.

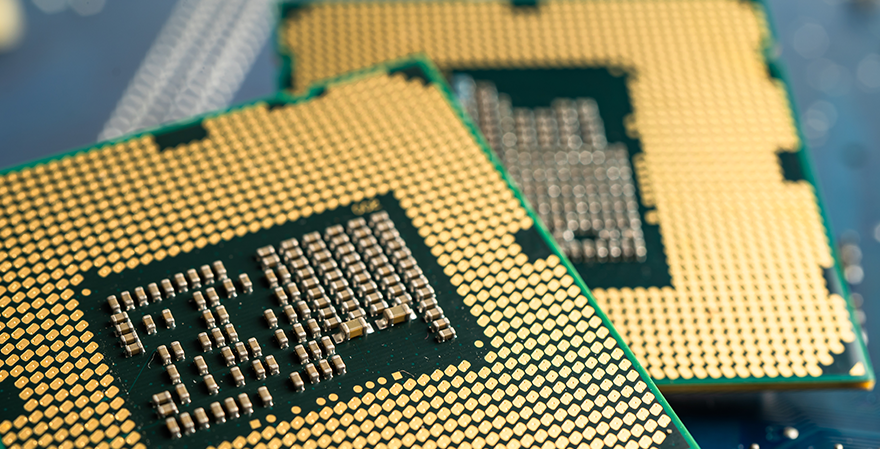

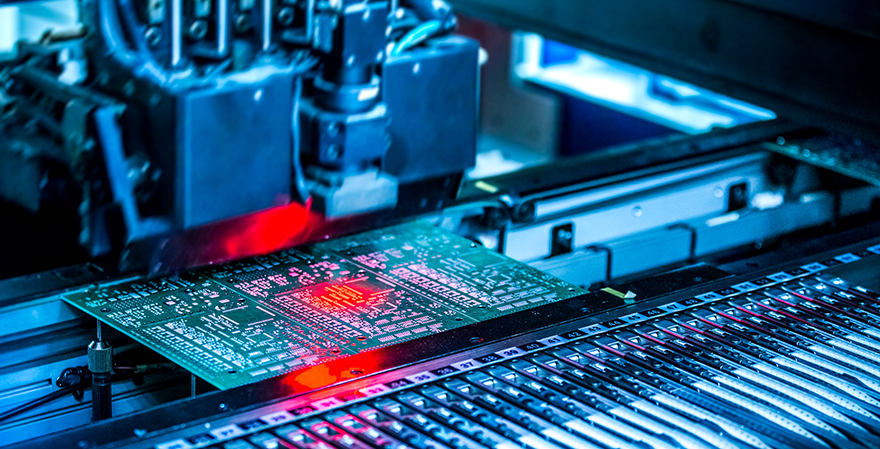

This surge in Nvidia's valuation coincides with a pivotal moment for the U.S. semiconductor industry, highlighted by the White House's announcement last week of a $1.5 billion grant to GlobalFoundries. This funding, part of the 2022 CHIPS Act, aims to rejuvenate U.S. semiconductor research and manufacturing—a critical move as the industry seeks to mitigate the effects of the global chip shortage that peaked during the late pandemic stages. However, despite this infusion of federal support, major semiconductor producers in the U.S., including Taiwan Semiconductor Manufacturing Company (TSMC) and Intel, have signaled delays in their expansion plans, with new factories' operational timelines pushed back, reflecting a slowdown in the urgency to expand post-shortage. The semiconductor landscape in the U.S. is poised for significant growth, with several major manufacturing projects underway. Intel's ambitious projects in Arizona and Samsung's upcoming facility near Austin, Texas, signal a robust expansion of semiconductor manufacturing capabilities. Meanwhile, TSMC's adjusted timeline for its Arizona factories and Texas Instruments' expansion in North Texas and future plans in Utah underscore the sector's strategic realignment. These developments, alongside the expected production of cutting-edge 5 nm and 3 nm logic chips critical for advanced technologies by TSMC and Samsung on American soil, highlight the strategic importance of the semiconductor industry to the U.S.'s technological independence.

As Nvidia celebrates its towering market valuation, the broader narrative of the U.S. semiconductor industry reflects a complex interplay of innovation, federal policy interventions, and strategic adjustments aimed at securing the nation's technological future. This industry's evolution, marked by significant investments and strategic delays, illustrates the balancing act between rapid growth and the meticulous planning required to sustain the U.S. as a global leader in semiconductor technology.